| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 |

- Absolute

- AGI

- ai

- AI agents

- AI engineer

- AI researcher

- ajax

- algorithm

- Algorithms

- aliases

- Array 객체

- ASI

- bayes' theorem

- Bit

- Blur

- BOM

- bootstrap

- canva

- challenges

- ChatGPT

- Today

- In Total

A Joyful AI Research Journey🌳😊

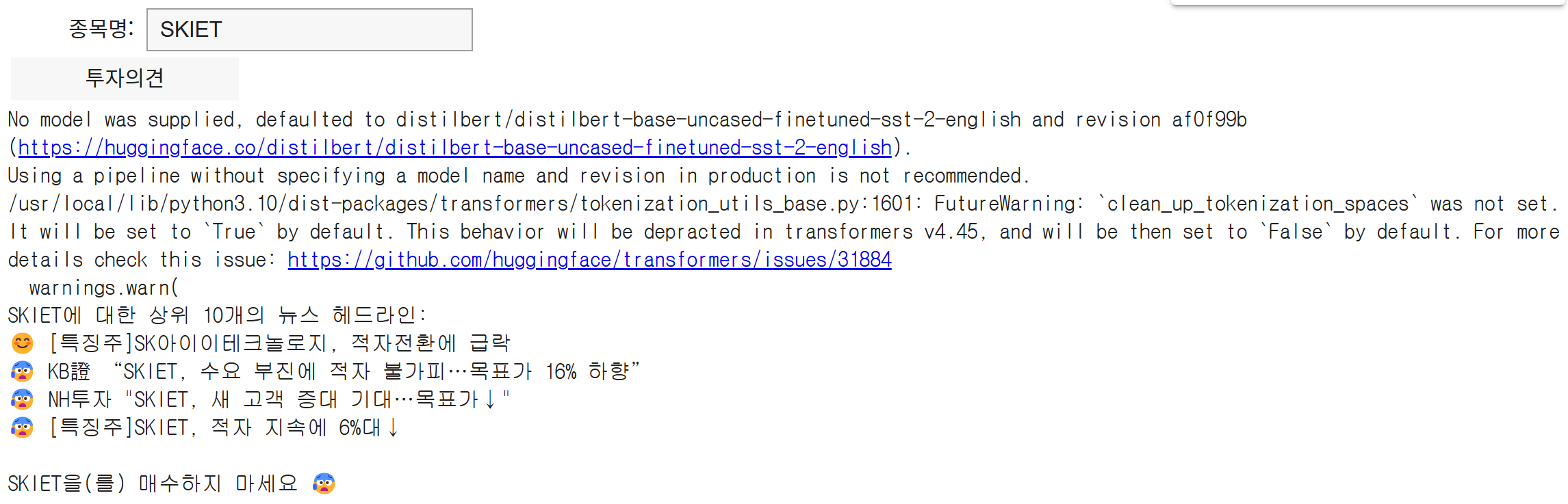

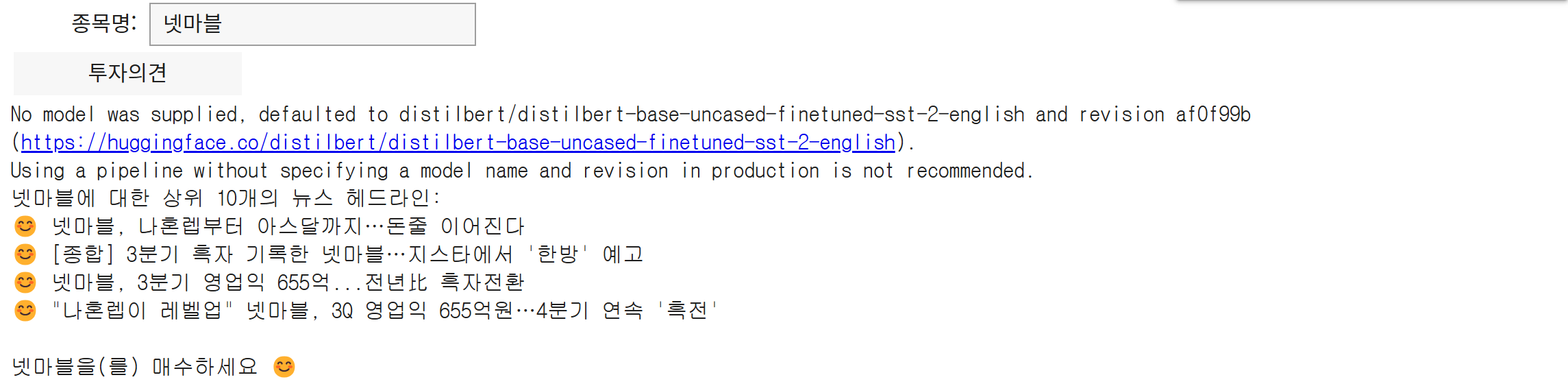

[6] 241106 Team Project Role: Stock Headline Sentiment Analysis [Goorm All-In-One Pass! AI Project Master - 4th Session, Day 6] 본문

[6] 241106 Team Project Role: Stock Headline Sentiment Analysis [Goorm All-In-One Pass! AI Project Master - 4th Session, Day 6]

yjyuwisely 2024. 11. 6. 15:12감성 분석 이슈

Neutral 안 해봄 해보자! 궁금하다

중립 감성 분석은 특정 텍스트가 긍정적이거나 부정적인 감성을 갖지 않고 중립적인 상태임을 평가하는 과정입니다. 감성 분석은 일반적으로 긍정, 중립, 부정의 세 가지 범주로 나눌 수 있으며, 중립 감성은 주로 감정이 명확하게 드러나지 않는 경우에 해당합니다.

공모주 상장 예정 등

감성 분석 -> 움직임! 구현 (나무, 할아버지)

ARIMA

LSTM(장기 단기 기억)

https://github.com/yjyuwisely/AI_project_mastery_bootcamp/blob/main/241107_stock_sentiment.ipynb

AI_project_mastery_bootcamp/241107_stock_sentiment.ipynb at main · yjyuwisely/AI_project_mastery_bootcamp

Goorm All-In-One Pass! AI Project Master Bootcamp. Contribute to yjyuwisely/AI_project_mastery_bootcamp development by creating an account on GitHub.

github.com

코드)

import requests

from bs4 import BeautifulSoup

from transformers import pipeline

import ipywidgets as widgets

def get_stock_buy_recommendation(stock_name):

"""

Fetch the top 10 news headlines related to the given stock, perform sentiment analysis using BERT, and provide a buy recommendation.

주어진 주식과 관련된 상위 10개의 뉴스 헤드라인을 가져오고, BERT를 사용하여 감정 분석을 수행한 뒤 매수 추천을 제공합니다.

Parameters:

stock_name (str): The name of the stock to search for

주식 이름 (str): 검색할 주식의 이름

Returns:

tuple: (list of (headline, sentiment_emoji), buy_recommendation_str)

튜플: (헤드라인과 감정 이모티콘의 리스트, 매수 추천 문자열)

"""

# Fetch news headlines from Naver search

# 네이버 검색에서 뉴스 헤드라인 가져오기

url = f'https://search.naver.com/search.naver?ie=utf8&sm=nws_hty&query={stock_name}'

response = requests.get(url)

soup = BeautifulSoup(response.content, 'html.parser')

# Extract the top 10 news headline text

# 상위 10개의 뉴스 헤드라인 텍스트 추출

headlines = [headline.get_text() for headline in soup.find_all('a', class_='news_tit')[:10]]

# Load the pre-trained BERT sentiment analysis model

# 사전 학습된 BERT 감정 분석 모델 로드

sentiment_analyzer = pipeline('sentiment-analysis')

# Perform sentiment analysis on each headline using BERT

# 각 헤드라인에 대해 BERT를 사용하여 감정 분석 수행

results = []

positive_count = 0

negative_count = 0

for headline in headlines:

sentiment = sentiment_analyzer(headline)[0]['label']

# Represent sentiment using emoji expressions

# 감정을 이모티콘으로 표현

if sentiment == 'POSITIVE':

sentiment_emoji = '😊'

positive_count += 1

elif sentiment == 'NEGATIVE':

sentiment_emoji = '😰'

negative_count += 1

else:

sentiment_emoji = '😐'

results.append((headline, sentiment_emoji))

# Determine the buy recommendation based on sentiment

# 감정 분석 결과에 따라 매수 추천 결정

if positive_count > negative_count:

buy_recommendation = f'{stock_name}을(를) 매수하세요 😊'

elif positive_count < negative_count:

buy_recommendation = f'{stock_name}을(를) 매수하지 마세요 😰'

else:

buy_recommendation = f'{stock_name}에 대해 중립적인 입장입니다 😐'

return results, buy_recommendation

# Create a text input widget for the user to enter a stock name

# 사용자가 주식 이름을 입력할 수 있는 텍스트 입력 위젯 생성

stock_input = widgets.Text(

value='',

placeholder='종목명을 입력하세요.',

description='종목명:',

disabled=False

)

# Create a button to trigger the sentiment analysis and recommendation

# 감정 분석과 추천을 실행할 버튼 생성

analyze_button = widgets.Button(description="투자의견")

# Create an output widget to display the results

# 결과를 표시할 출력 위젯 생성

output = widgets.Output()

27.

# Define a function to handle the button click

# 버튼 클릭을 처리하는 함수 정의

def get_recommendation(button):

with output:

output.clear_output() # Clear previous output before displaying new results / 이전 결과를 지우고 새 결과 표시

stock_name = stock_input.value

headline_results, buy_recommendation = get_stock_buy_recommendation(stock_name)

# Display the news headlines and sentiment

# 뉴스 헤드라인과 감정 분석 결과 표시

print(f'{stock_name}에 대한 상위 10개의 뉴스 헤드라인:')

for headline, emoji in headline_results:

print(f'{emoji} {headline}')

# Display the buy recommendation

# 매수 추천 표시

print()

print(buy_recommendation)

# Add the widgets to the Colab notebook

# Colab 노트북에 위젯 추가

display(stock_input, analyze_button, output)

# Connect the button click to the get_recommendation function

# 버튼 클릭을 get_recommendation 함수에 연결

analyze_button.on_click(get_recommendation)결과)

뉴스 감정 분석 및 이벤트 영향 표시

- 뉴스 헤드라인 감정 분석: 최근 주식과 관련된 뉴스 기사나 소셜 미디어 데이터를 수집하여, 감정 분석을 통해 긍정적, 부정적, 중립적인 의견을 분류할 수 있어요. 이를 통해 사용자에게 최근 뉴스가 주식에 어떤 영향을 미치는지 보여줄 수 있습니다.

- 단기 예측 모델 추가: 주가의 단기 예측을 위해 ARIMA, LSTM, Prophet 등의 타임 시리즈 예측 모델을 추가하여 사용자에게 며칠 뒤 주가의 변동 가능성을 제공할 수 있습니다.

소셜 미디어 트렌드 분석

- 트위터, Reddit, 기타 SNS 분석: 특정 주식에 대한 소셜 미디어의 반응을 수집하고 이를 바탕으로 트렌드를 시각화하여 사용자에게 트레이딩 아이디어를 제공할 수 있습니다.

https://github.com/hello22433/AI_JooAU_firstproject

GitHub - hello22433/AI_JooAU_firstproject

Contribute to hello22433/AI_JooAU_firstproject development by creating an account on GitHub.

github.com

241106 Wed 6th class

http://data.krx.co.kr/contents/MDC/MAIN/main/index.cmd

KRX 정보데이터시스템

증권·파생상품의 시장정보(Marketdata), 공매도정보, 투자분석정보(SMILE) 등 한국거래소의 정보데이터를 통합하여 제공 서비스

data.krx.co.kr

워드클라우드 + 주식 매수/매도에 대한 평가

워드에 관련된 뉴스기사에 댓글 같은 게 있을건데 그 댓글을 사람의 표정으로 시각화시키는 건 어떨까요 ?

키워드에 대한 사람들의 감정을 평가하는 자료로 쓸 수 있지 않을까 싶습니다 직관적으로

그 관련 기사 또는 사람들 댓글을 웹 스크롤링해서 사람들의 감성을 이모티콘(긍정 / 부정)으로 표현한다

그 감정에 대한 판단도 데이터분석을 이용할 수 있을 것 같아서요 컴퓨터가 감정을 인식하는 센서가 없으니 인공지능 코드를 활용할 수 있을 것 같습니다

- 뉴스 헤드라인 감정 분석: 최근 주식과 관련된 뉴스 기사나 소셜 미디어 데이터를 수집하여, 감정 분석을 통해 긍정적, 부정적, 중립적인 의견을 분류할 수 있어요. 이를 통해 사용자에게 최근 뉴스가 주식에 어떤 영향을 미치는지 보여줄 수 있습니다.

- 기술적 지표 계산 및 시각화

- 이동 평균선 (Moving Averages): 단기 및 장기 이동 평균선을 차트에 함께 표시하여 골든 크로스나 데드 크로스를 확인할 수 있게 할 수 있습니다. 이는 사용자가 트렌드를 쉽게 파악하는 데 도움을 줍니다.

- RSI (Relative Strength Index): RSI는 특정 주식이 과매도 되었는지 과매수 되었는지를 파악하는 데 유용합니다. RSI 그래프를 추가하여 사용자에게 매수/매도 타이밍에 대한 추가적인 정보를 제공할 수 있습니다.

- MACD (Moving Average Convergence Divergence): MACD를 추가하여 사용자가 모멘텀의 변화를 쉽게 파악할 수 있게 할 수 있습니다.

- 소셜 미디어 트렌드 분석: 트위터, Reddit, 기타 SNS 분석: 특정 주식에 대한 소셜 미디어의 반응을 수집하고 이를 바탕으로 트렌드를 시각화하여 사용자에게 트레이딩 아이디어를 제공할 수 있습니다.

현재 프로젝트에 추가할 수 있는 흥미로운 기능들이 많아요. 워드클라우드와 매수/매도 평가 외에도 사용자에게 더 풍부한 정보를 제공하고 주식 투자의 결정을 도울 수 있는 몇 가지 추가 기능을 추천드릴게요:

1. 뉴스 감정 분석 및 이벤트 영향 표시

- 뉴스 헤드라인 감정 분석: 최근 주식과 관련된 뉴스 기사나 소셜 미디어 데이터를 수집하여, 감정 분석을 통해 긍정적, 부정적, 중립적인 의견을 분류할 수 있어요. 이를 통해 사용자에게 최근 뉴스가 주식에 어떤 영향을 미치는지 보여줄 수 있습니다.

- 이벤트 매핑: 특정 날짜에 주요 이벤트(예: 실적 발표, 정책 변경, 주요 회사 뉴스 등)가 있었는지를 차트에 표시하고 해당 이벤트가 주가에 미친 영향을 시각적으로 나타낼 수 있어요.

2. 기술적 지표 계산 및 시각화

- 이동 평균선 (Moving Averages): 단기 및 장기 이동 평균선을 차트에 함께 표시하여 골든 크로스나 데드 크로스를 확인할 수 있게 할 수 있습니다. 이는 사용자가 트렌드를 쉽게 파악하는 데 도움을 줍니다.

- RSI (Relative Strength Index): RSI는 특정 주식이 과매도 되었는지 과매수 되었는지를 파악하는 데 유용합니다. RSI 그래프를 추가하여 사용자에게 매수/매도 타이밍에 대한 추가적인 정보를 제공할 수 있습니다.

- MACD (Moving Average Convergence Divergence): MACD를 추가하여 사용자가 모멘텀의 변화를 쉽게 파악할 수 있게 할 수 있습니다.

3. 주가 예측 기능

- 단기 예측 모델 추가: 주가의 단기 예측을 위해 ARIMA, LSTM, Prophet 등의 타임 시리즈 예측 모델을 추가하여 사용자에게 며칠 뒤 주가의 변동 가능성을 제공할 수 있습니다.

- 시나리오 기반 예측: 여러 가지 시나리오 (예: 경제 성장률 변화, 금리 인상 등)와 같은 외부 요인을 가정하고 주가가 어떻게 변할지 예측하는 시나리오 분석 기능을 제공할 수 있습니다.

4. 포트폴리오 관리 및 백테스팅

- 가상 포트폴리오 관리: 사용자가 가상의 주식을 매수하거나 매도해 포트폴리오를 관리할 수 있도록 해 보세요. 이를 통해 사용자는 자신의 전략이 어떻게 작동하는지 시뮬레이션해볼 수 있습니다.

- 백테스팅 기능: 특정 전략에 따라 가상으로 투자했을 때 과거 데이터에서 어떤 성과를 보였는지를 평가할 수 있도록 백테스팅 기능을 추가해 보세요. 이를 통해 사용자는 전략의 유효성을 확인할 수 있습니다.

5. 리스크 평가 및 분산 투자 추천

- 변동성 분석 (Volatility Analysis): 각 주식의 변동성을 시각화하여, 사용자가 투자 리스크를 이해하는 데 도움을 줄 수 있습니다.

- 샤프 지수 (Sharpe Ratio): 주식의 수익률과 변동성을 바탕으로 샤프 지수를 계산해 제공함으로써 리스크 대비 수익률을 평가하는 데 도움을 줄 수 있습니다.

- 분산 투자 추천: 주식 외에도 ETF, 채권 등 분산된 투자 포트폴리오를 추천해 리스크를 줄이는 전략을 제안할 수 있습니다.

6. 유저 개인화 피드백 및 학습 기능

- 개인화된 투자 조언: 사용자의 투자 성향을 분석해 개인화된 투자 조언을 제공해 보세요. 예를 들어, 사용자가 주식의 변동성을 선호하지 않는다면 안정적인 자산 추천을 할 수 있습니다.

- 학습 자료 제공: 초보 투자자들이 기본적인 기술적 분석이나 재무 분석을 이해할 수 있도록 관련 학습 자료나 간단한 튜토리얼을 제공할 수 있습니다.

7. 시장 대비 성과 비교

- 벤치마크 비교: 사용자가 선택한 주식의 성과를 시장 지수(예: KOSPI, S&P 500)와 비교하여 해당 주식이 시장 대비 얼마나 좋은 성과를 냈는지 한눈에 볼 수 있는 기능을 추가해 보세요.

- 동종 업계 비교: 동일 업종의 다른 주식과 비교하여 해당 주식의 상대적 위치를 평가할 수 있도록 시각화 자료를 제공할 수 있습니다.

8. 소셜 미디어 트렌드 분석

- 트위터, Reddit, 기타 SNS 분석: 특정 주식에 대한 소셜 미디어의 반응을 수집하고 이를 바탕으로 트렌드를 시각화하여 사용자에게 트레이딩 아이디어를 제공할 수 있습니다.

결론

이러한 기능들은 주식에 대한 이해도를 높이고, 사용자가 더 나은 결정을 내리는 데 큰 도움을 줄 수 있을 것입니다. 추천드린 기능 중 일부는 사용자 인터페이스를 풍부하게 하고, 일부는 실질적인 투자 결정에 중요한 통찰을 줄 수 있기 때문에, 이들 중에서 여러분의 팀 목표와 사용자 니즈에 맞는 기능을 선택해 보시면 좋겠습니다.

어떤 기능이 제일 흥미롭게 느껴지나요? 구체적으로 구현해보고 싶은 부분이 있다면 추가적인 설명이나 코드 샘플도 도와드릴 수 있어요!

It sounds like a great idea to enhance your Streamlit-based stock information website by incorporating an AI-driven recommendation system! Adding a "Buy" or "Sell" recommendation can add real value to users, making your platform more than just informational—it becomes a decision-making assistant. Here’s how you can go about it:

- Define the Scope of AI Recommendations:

- Determine the features that your AI model will use to predict whether a stock is a buy, hold, or sell. Common features include historical stock prices, technical indicators (e.g., moving averages, RSI), volume, recent news sentiment, or other financial ratios.

- Collect Relevant Data:

- You might need historical data for the stocks you're covering, including daily closing prices, volume, financial indicators, etc.

- You can get financial data from APIs like Yahoo Finance (yfinance), Alpha Vantage, or Quandl.

- If you plan to include news sentiment, you could use news APIs or scrape news websites to get recent articles and then perform sentiment analysis.

- Train the AI Model:

- Algorithm: Start simple, with a machine learning model like a Random Forest Classifier or an SVM, which can be a good baseline for classification.

- Alternatively, you could use a deep learning model if you have enough data or you want to try time series models (e.g., LSTMs).

- Training Data: Collect data for many stocks, including historical price, volume, and other technical indicators, to train your model to recognize patterns indicative of buy or sell signals.

- You can also use technical analysis metrics like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to enhance your prediction capabilities.

- Integrate AI into the Streamlit App:

- Use sklearn or other machine learning libraries to load your trained model.

- Create an input section where users can provide data about a specific stock (e.g., recent trends, price history) or even allow them to select a stock and pull this data automatically.

- Make predictions in real-time when a user selects a stock and display the recommendation using a "Buy", "Sell", or "Hold" indicator.

- Enhance User Experience:

- Use Streamlit’s visualization capabilities to add charts and indicators that explain the AI's recommendation.

- For instance, you could show the stock’s recent trends, highlight key technical indicators used, and display a probability score from the model to show how confident it is in the recommendation.

- Example Layout of the App:

- Header: Brief introduction to what your website does.

- Sidebar: Selection of the stock, date range, and other relevant filters.

- Main Section:

- Stock Information: Show general information about the selected stock, including historical performance and 시각화 using tools like matplotlib or plotly.

- AI Recommendation: Show the recommendation (Buy, Sell, Hold) along with a confidence score.

- Graphs: Plot the stock's recent trend, along with technical indicators that the model is using to make predictions.

Tools and Technologies

- Data Collection: yfinance, Alpha Vantage API, Quandl.

- Machine Learning Model: Python (scikit-learn, TensorFlow, or PyTorch).

- Front-end: Streamlit for website building and visualization (matplotlib, plotly for charts).

- Deployment: Deploy the Streamlit app using services like Heroku or Streamlit Cloud.

import streamlit as st

import yfinance as yf

from sklearn.externals import joblib

# Load pre-trained model

model = joblib.load('stock_model.pkl')

st.title('Stock Information and AI Recommendation')

stock_symbol = st.text_input('Enter Stock Symbol', 'AAPL')

if st.button('Get Stock Info and Recommendation'):

stock_data = yf.Ticker(stock_symbol).history(period='1y')

st.line_chart(stock_data['Close'])

# Get some features for prediction (example)

features = [stock_data['Close'].iloc[-1], stock_data['Volume'].iloc[-1]]

recommendation = model.predict([features])[0]

if recommendation == 1:

st.write("**Recommendation: Buy**")

elif recommendation == -1:

st.write("**Recommendation: Sell**")

else:

st.write("**Recommendation: Hold**")